Thank you! Your submission has been received

Mercy Benn - Itua

An Overview

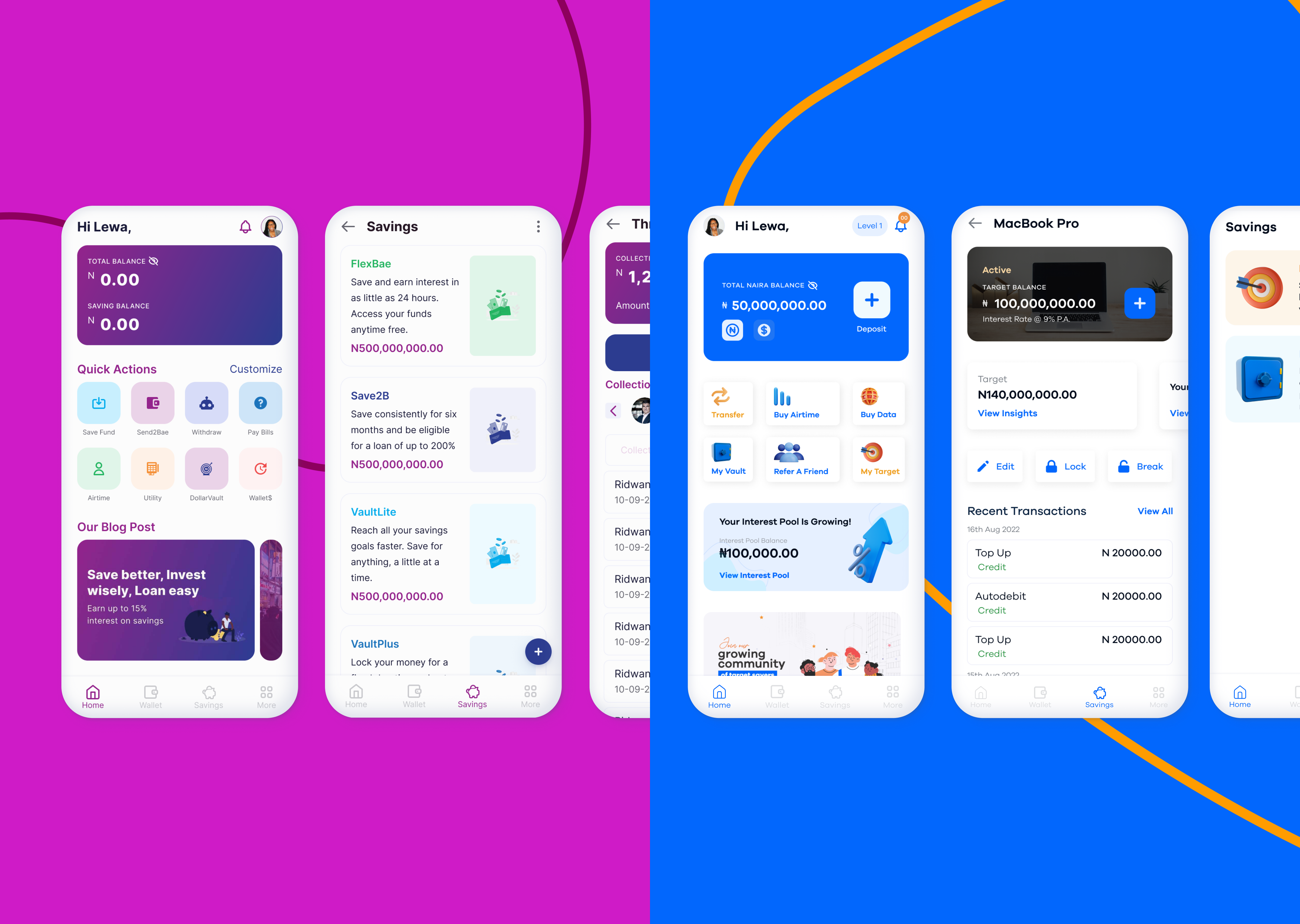

Meet Vale

Vale is a personal banking platform that empowers individuals with an all in one platform to carry out daily transactions, save, and pay everyday bills.

The Challange

With a working product in the market, we dicovered from feedback from our users and in line with the business goals a growing need for individuals to manage their finances seamlessly in an all in one reliable platform and carry out daily transactions easily while being motivated to reach thier savings goals.

This revelation paved the way for 'Vale' - a more personal, reliable, and flexible banking partner.

Research & Discovery

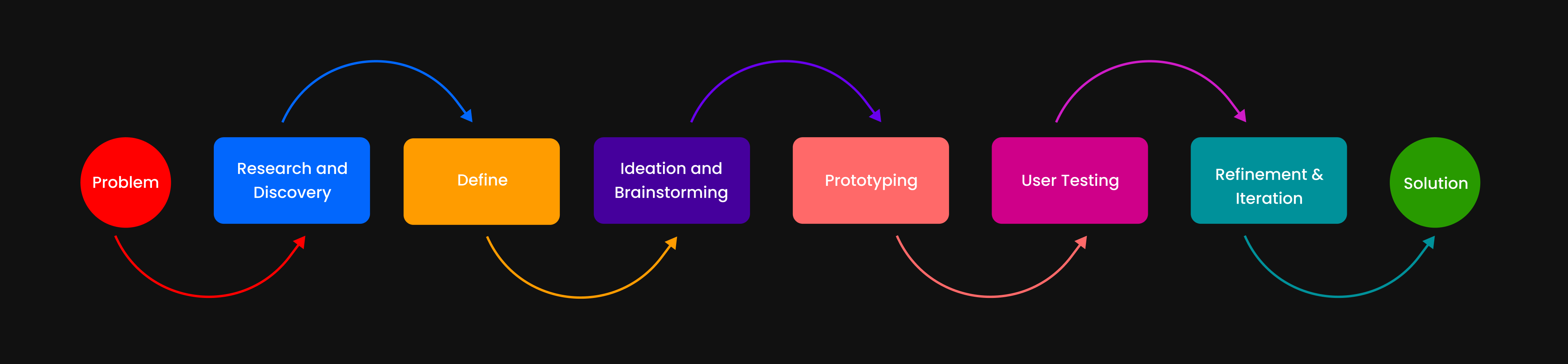

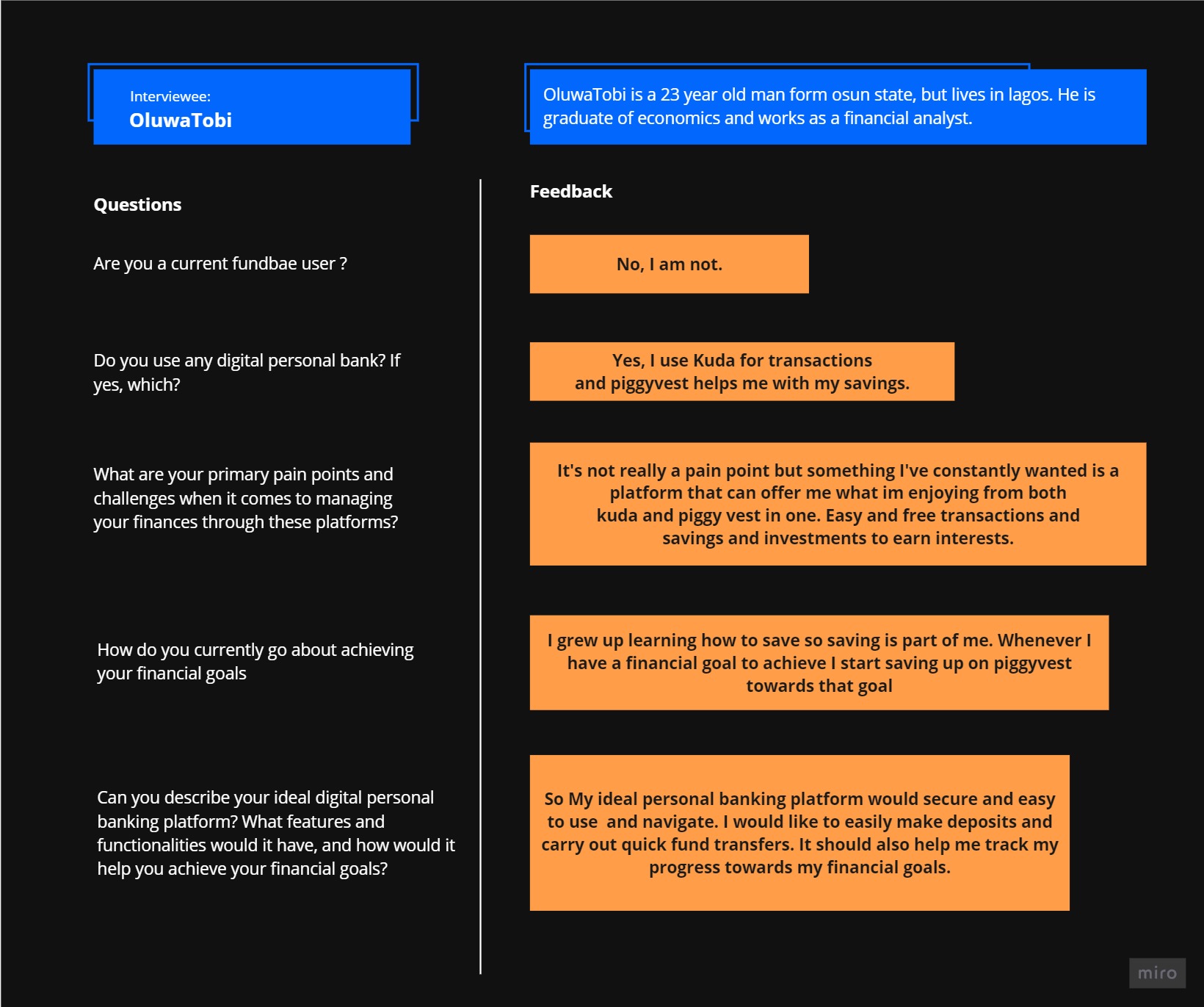

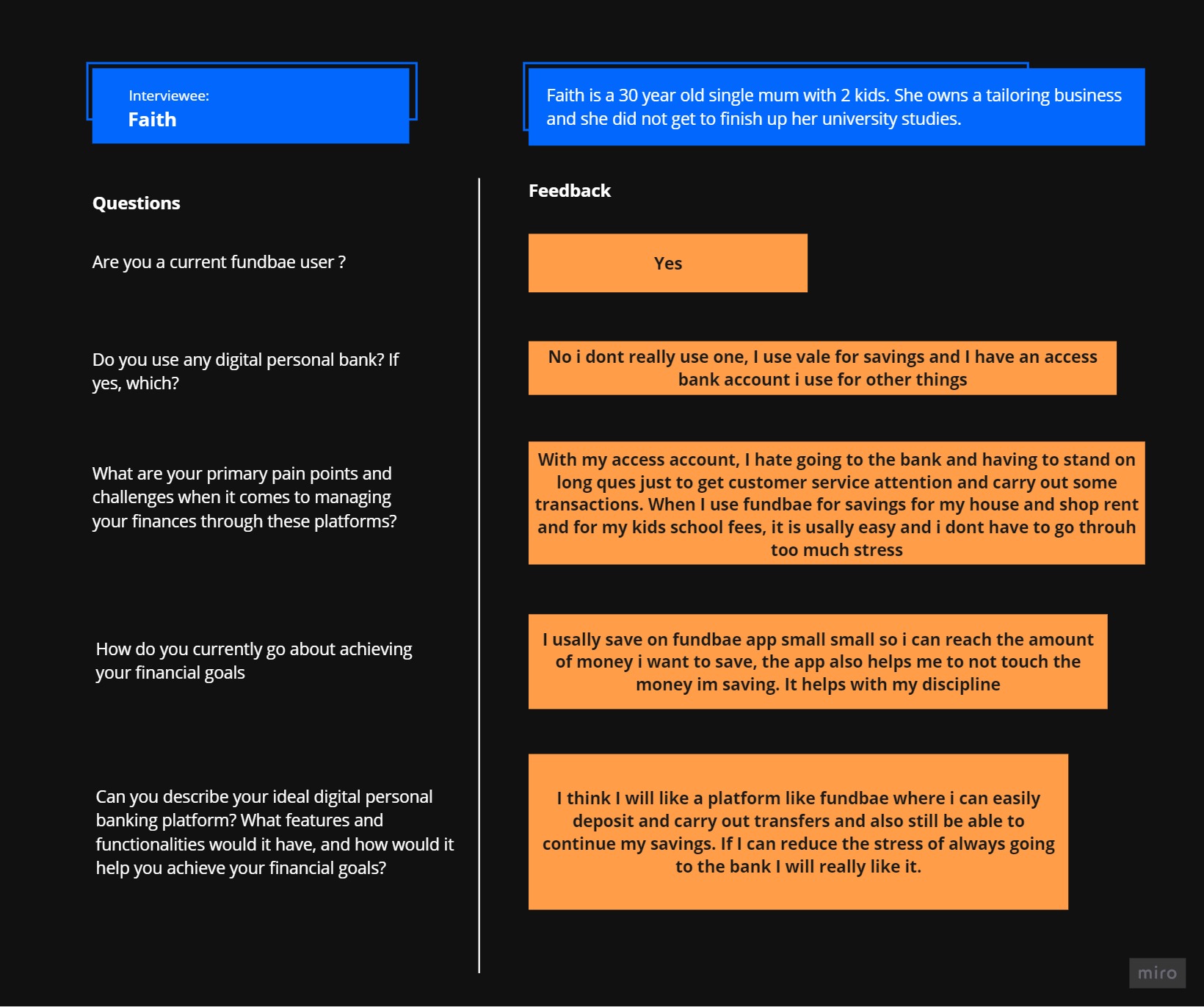

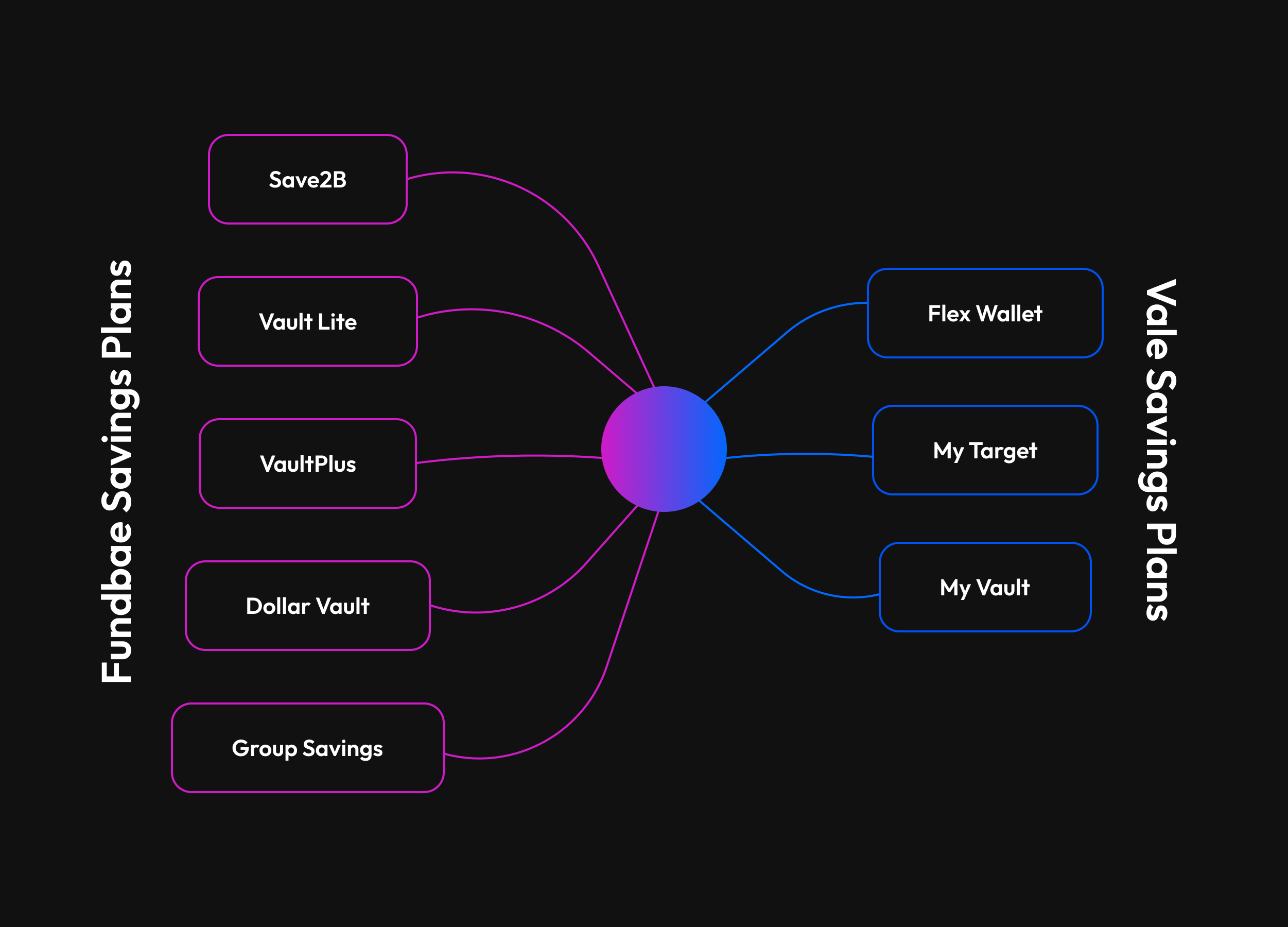

To ensure I had a good understanding of the problem and challenges at hand, I conducted an extensive qualitative research process that involved engaging with users of the existing savings and investment product offered by Fundbae (now Vale). Fundbae, had six different savings plans in their product portfolio. Through targeted interviews, I sought to gather insights from both frequent users of Fundbae's savings and investment product and potential users who were tech-savvy and already utilizing other digital banking services.

User Research

With a user base of over 30,000 individuals at the time, I engaged in targeted interviews with 20 frequent users of the existing savings and investment product. This sample represented a diverse range of users. Additionally, I expanded my research by conducting interviews with 10 non-users. This helped provide valuable insights from different perspectives.

Research Goals

The primary objectives of the research were:

Identify users' primary pain points, challenges, and needs related to a digital personal banking platform.

Explore the need and opportunities for a new digital personal banking product.

Understand how users perceive and utilize personal banking platforms in general.

Gain insights into users' financial goals and their current strategies for achieving them.

Research & Discovery

Research Insights

From the interviews I conducted, I found that there were a few common problems and needs that most of them had. One of the main concerns was how hard it was to manage different financial products for different reasons. Also, people want applications that are easy to use and don't take a lot of time to carry out transactions. They also wanted payment services that were simple and easy to use.

The insights obtained from the research allowed me to effectively address the research goals set at the beginning of the process. Through thorough research, I reached the following key conclusions:

Pain Points and Needs: Through the interviews, I was able to figure out what the main problems, difficulties, and needs of our users were when it came to digital personal banking platforms. The research showed how hard it is to manage different financial products for different purposes and how important it is to have a simple solution that encompasses all thier financial needs in one.

Need and Opportunities for a New Product: By finding out what users didn't like about current platforms and what problems they had with them, I found gaps and opportunities for innovation such as providing a products that helps users handle all thier financial needs, from payments, to savings and investments, a product with simple and easy to navigate user interface e.t.c.

Users' Financial Goals and Strategies: From the interviews, it was clear that users had a strong desire to save for specific goals, spend wisely, and make transactions easily so they could reach their financial goals. By figuring out what users want and how they act, this layed the groundwork for designing features and functions that help with goal-based saving, smart investment options, and smooth transactions.

Reasearch & Discovery

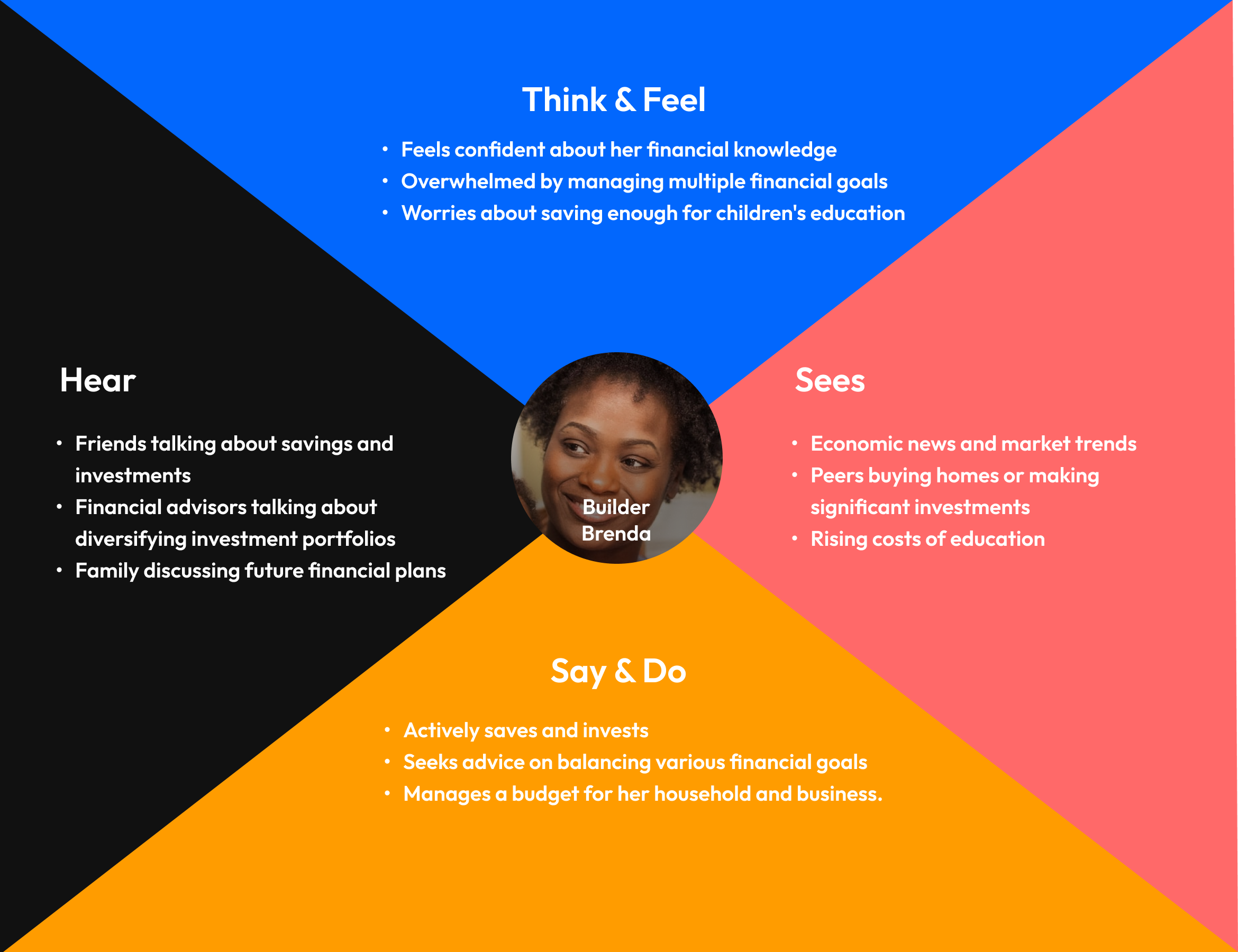

Empathy Maps

After conducting thorough research and making user personas, the next step in my design process was to learn more about how each user persona felt, thought, and acted. I had to deal with a wide range of users with different ages, backgrounds, wants, and needs, so I chose to make an empathy map. This helped me figure out more about how each user group thinks, feels, and acts. By making a visual map of their experiences, pain points, goals, and motives, I could understand them better and create design solutions that solve for them accurately.

Identifying Needs & Opportunities

Define

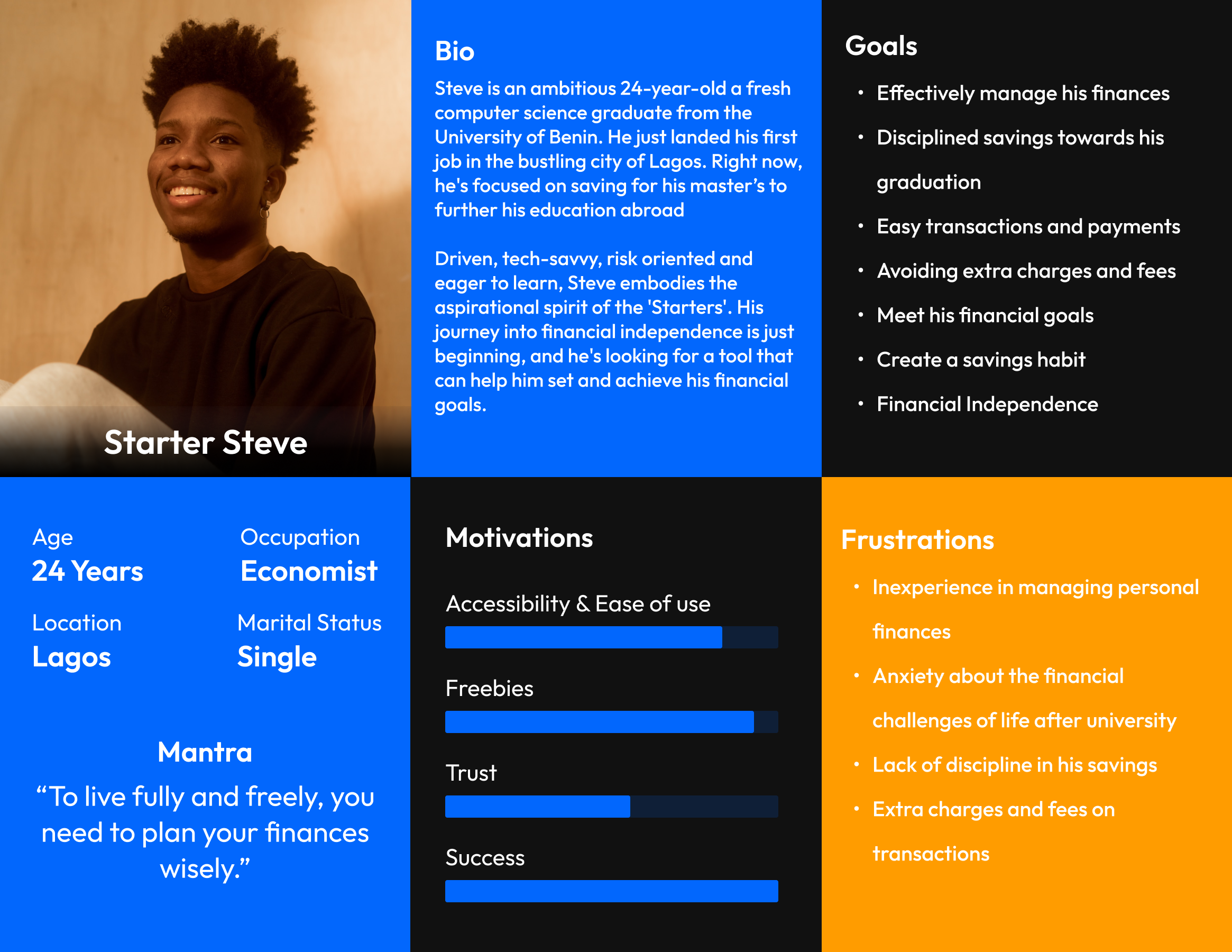

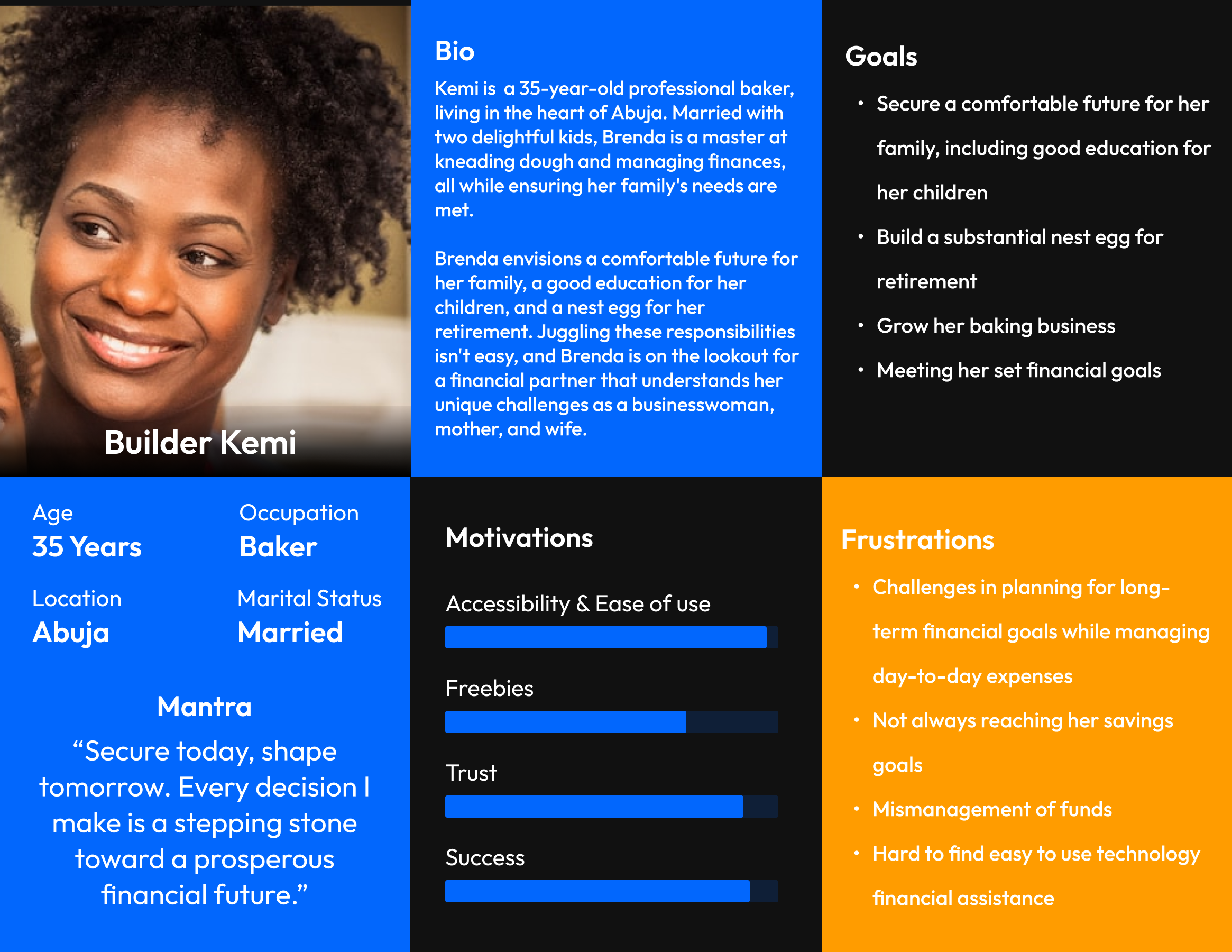

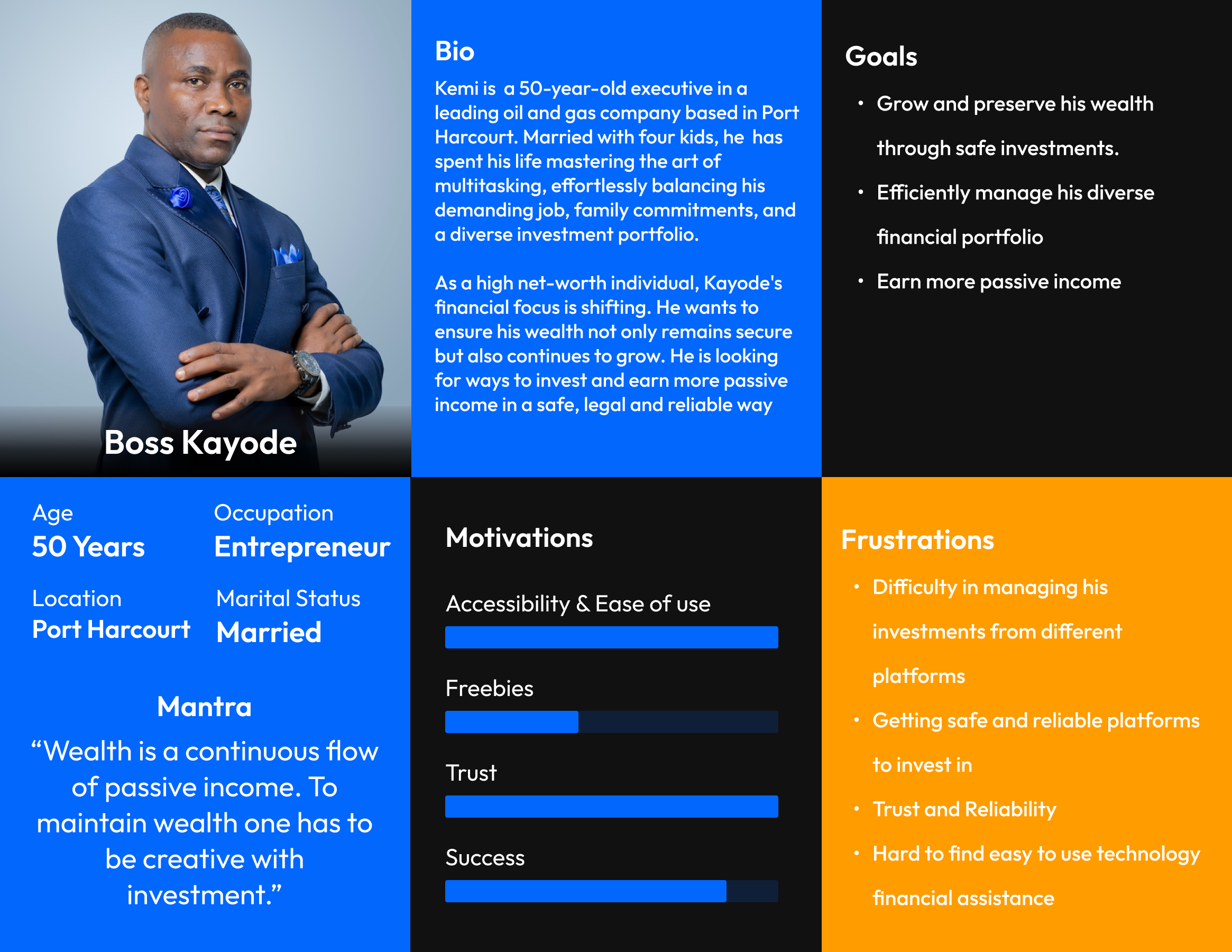

With a wealth of insights gained from an extensive research and discovery process, I had a comprehensive understanding of the primary user needs within my target audience. These insights revealed three critical areas that, if effectively addressed, would meet the needs and solve the pain points for individuals across the three demographic groups I had created (Starters, builders, and Bosses).

These were:

Seamless Transactions and Payments

Investment Opportunities and Wealth Management

Goal-Oriented Savings

By allowing these three key areas to guide my design decisions and processes, I hoped to meet the goals, fix the pain points, and come up with a complete solution that would help people across the Starters, Builders, and Bosses demographic groups.

Business Goals

To match the user needs needs with the business goals, I saw how each user need could lead to achieving the set business goals for Vale:

Brainstorming

Ideation

After defining our user's primary needs and aligning them with business goals, the next step was to ideate on how to present these value propositions to our cutomers. Fundbae(Now vale) had 6 savings plans and from my research I broke this down to just 3 savings plans. Why? Stay with me.